PORTFOLIO

Delivering Value through Targeted Real

Estate Investing

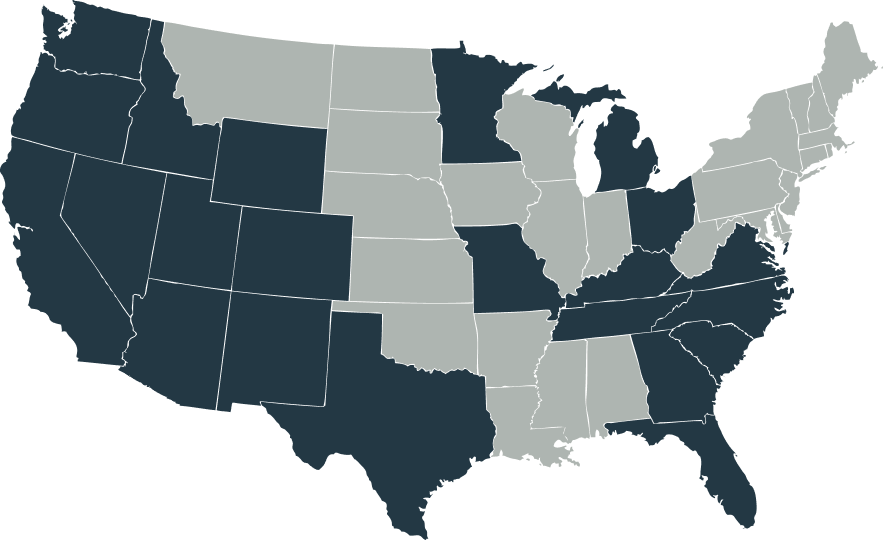

National Footprint

Peak owns workforce and affordable housing properties in over 20 growth markets across the United States, with a focus on the Mountain West, Midwest, and Sunbelt regions.

Recognized as a leader in real estate

Our extensive track record of growth, success and economic contribution has received significant recognition.

case study

ARVADA, CO

Maple Leaf

Local Presence Leads to Superior Performance

Peak purchased Maple Leaf a 71-unit property in 2019 in a strong neighborhood of Denver. Our disciplined acquisition criteria and strong reputation with a repeat broker and seller led to an attractive basis at acquisition.

We leveraged our local operating platform and market expertise to grow NOI performance through an elevated resident experience and strong lease renewals through changing market cycles.

case study

DEVONDALE, KY

Ashton Brook

Stringent Management through Vertical-Integration

Peak acquired Ashton Brook in 2018, a 274-unit community in a prime Louisville location. Built in 1979, the property had begun interior renovations in 2017, prior to our ownership. Peak’s team of asset manager, project manager, and local leadership continued the interior renovations and completed full exterior and amenity improvements.

Our vertically-integrated team successfully increased the asset value by optimizing income post-improvements.

case study

BURNSVILLE, MN

Summit Townhomes

Creating Spaces Residents Want To Live

Peak acquired Summit Townhomes in 2018, a quality 114-unit asset with minimum deferred maintenance.

Targeted interior/exterior unit upgrades along with an extensive community amenity package led to increased resident satisfaction. Our focus on creating safe, clean and affordable communities for working families and individuals, serves our residents and drives value for our investors.

case study

JACKSONVILLE, FL

Crescent Ridge

Buying Core Plus Assets in Great Locations for Steady Cash flow

Crescent Ridge a 350-unit property was acquired in 2018. This attractive property within the economically strong Jacksonville boasts a variety of amenities, including two swimming pools, lake views, sport courts, a playground, and a car-wash area.

The strategic combination of a great asset in a great location resulted in impressive value creation throughout Peak’s ownership.

case study

BLUFFDALE, UT

Beacon Hill

High-Quality Affordable Communities in

Quality Markets

Beacon Hill is a 168-unit high-quality LIHTC property located near key transit corridors and major employment hubs. Peak acquired this newly built community in 2016 well below replacement cost and at an attractive cap rate, and has managed operations to date.

The excellent location, build quality, and affordability of this community has contributed to the consistently strong occupancy and NOI growth over its hold period.

Approach

We are a vertically-integrated owner-operator, with disciplined acquisition criteria and an extensive track record of success.